A new roof is a significant investment, but not everyone has the cash readily available to cover the cost upfront. Fortunately, roof financing options make it easier for homeowners to afford necessary roofing projects without breaking the bank. Whether you’re dealing with storm damage, an aging roof, or looking to upgrade, financing solutions can help you spread out payments in a way that fits your budget.

At SmartPRO Roofing, we understand that affordability plays a crucial role in home improvement decisions. That’s why we offer SmartQuote financing, a simple and transparent way to explore various roofing payment plans tailored to your financial needs. By leveraging digital tools, SmartQuote revolutionizes the roofing industry by making financing straightforward, helping homeowners secure professional roofing in Florida without unnecessary stress.

Why Roof Financing Matters

According to the National Association of Realtors (NAR), a new roof has an average return on investment (ROI) of 60-70%, making it one of the most valuable home improvements. However, costs can range anywhere from $8,000 to $25,000, depending on materials and labor. Without financing, many homeowners delay necessary repairs, which can lead to structural damage, leaks, and higher costs down the line.

With roof financing options, homeowners can:

- Get the roofing services they need without waiting for full payment.

- Protect their home from further damage and costly repairs.

- Maintain their property value while managing monthly expenses efficiently.

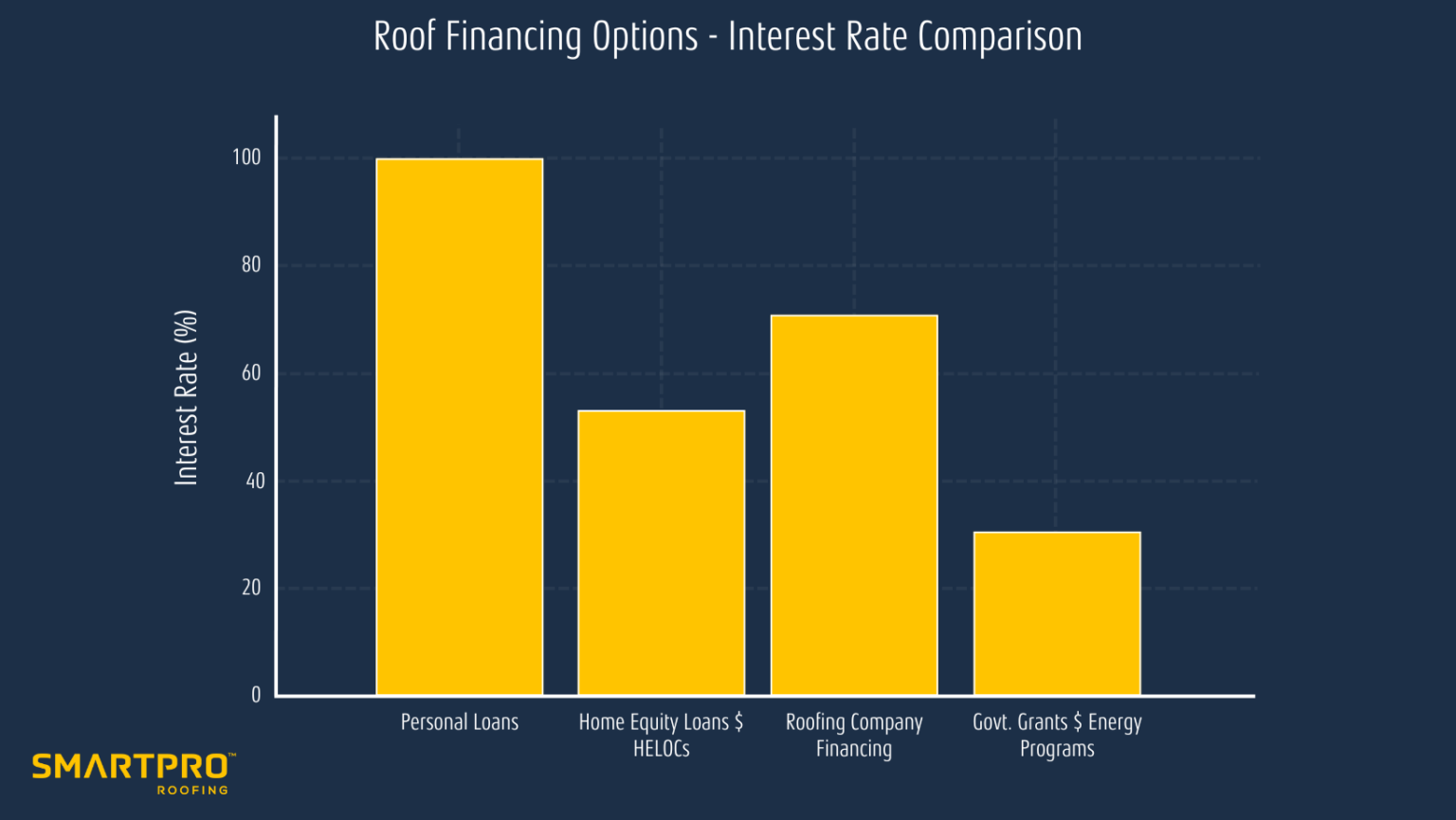

Understanding Roof Financing Options

There are several roofing payment plans available, each catering to different budgets and financial situations. Here are the most common ones:

1. Personal Loans for Roof Financing

Personal loans are an excellent option for homeowners who need immediate funds for roof replacement or repair. Banks, credit unions, and online lenders offer these loans, which typically range from $5,000 to $50,000. The repayment terms can vary from 12 months to 7 years, depending on the lender and the borrower’s creditworthiness.

Pros:

✅ Quick approval process

✅ No need to use your home as collateral

✅ Fixed interest rates for predictable monthly payments

Cons:

❌ Higher interest rates compared to secured loans

❌ Requires good credit for favorable terms

2. Home Equity Loans & HELOCs

A home equity loan or home equity line of credit (HELOC) allows homeowners to borrow against the equity they’ve built in their home. These loans generally offer lower interest rates since they are secured by your property.

Pros:

✅ Lower interest rates compared to personal loans

✅ Longer repayment terms for lower monthly payments

✅ Possible tax benefits (consult a tax advisor)

Cons:

❌ Risk of losing your home if you default on payments

❌ Longer approval process compared to personal loans

3. Roofing Company Financing (SmartQuote)

Many professional roofing companies, including SmartPRO Roofing, offer in-house financing options through SmartQuote financing. This digital financing system allows homeowners to receive real-time financing offers based on their project details.

Pros:

✅ Convenient application directly through SmartPRO Roofing

✅ Flexible repayment terms tailored to your budget

✅ Seamless integration with digital roofing innovation

Cons:

❌ Interest rates may vary depending on credit score

❌ Not all financing plans cover luxury roofing materials

4. Government Grants and Energy-Efficient Roofing Programs

Certain government programs, like the FHA Title I Loan or PACE (Property Assessed Clean Energy) financing, help homeowners finance roofing projects, especially those focused on energy efficiency. These programs often come with lower interest rates and incentives for solar roofs or eco-friendly materials.

Pros:

✅ Potential savings on energy bills

✅ Some programs offer low or zero-interest loans

✅ Increases property value with sustainable roofing solutions

Cons:

❌ Limited availability based on location

❌ Application processes can be lengthy

How SmartQuote Simplifies Roof Financing

With so many financing options available, choosing the right one can be overwhelming. That’s where SmartQuote steps in. Designed to simplify the roof-buying process, SmartQuote provides homeowners with an easy-to-use, digital financing platform that matches them with the best roofing payment plans based on their financial profile and project details.

1. Instant Digital Estimates with Transparent Pricing

Traditional roofing estimates often involve in-person inspections, unclear costs, and long wait times. SmartQuote revolutionizes this by delivering instant, itemized estimates with clear breakdowns of materials, labor, and financing options. This means no hidden fees, no guesswork—just accurate, upfront pricing based on real-time data.

2. Personalized Roofing Payment Plans

Instead of a one-size-fits-all approach, SmartQuote financing tailors payment options based on:

✔ Your budget and financial preferences

✔ Loan term flexibility (short-term vs. long-term financing)

✔ Eligibility for special discounts or zero-interest promotional plans

By doing this, homeowners can compare multiple financing options without having to fill out multiple applications or go through complicated paperwork.

3. Hassle-Free Online Application

Unlike traditional roof financing options, which often require in-person bank visits and long approval wait times, SmartQuote’s digital roofing innovation allows you to apply for financing directly through the platform. With a few clicks, homeowners can:

✅ Check eligibility instantly

✅ Compare different roofing payment plans

✅ Secure financing with minimal documentation

This streamlined process ensures that homeowners can move forward with their roofing project without delays.

4. Integration with SmartPRO Roofing for Professional Service

Choosing SmartQuote financing means you’re not just getting a flexible payment plan—you’re also partnering with SmartPRO Roofing, a trusted name in professional roofing in Florida. This ensures that your project is handled by experienced professionals who prioritize quality, affordability, and customer satisfaction.

The SmartQuote Advantage: A Smarter Way to Finance Your Roof

SmartQuote isn’t just about making financing easier—it’s about empowering homeowners with:

✔ Transparency: No hidden fees or unexpected costs

✔ Convenience: Full financing options available online, 24/7

✔ Affordability: Flexible plans that fit different budgets

By using SmartQuote, homeowners can confidently move forward with their roofing project, knowing they have the best financing solution at their fingertips.

Get Started with SmartQuote Today!

Looking for flexible roof financing options? Visit SmartPRO Roofing and start your SmartQuote journey today!

Related Reading: SmartQuote vs. Competitors: What Makes It the Best Choice?