Insurance will cover a roof replacement if the roof was damaged by a covered event such as a hurricane, hailstorm, or windstorm which are common in Florida. Normal wear and tear, aging shingles, or poor maintenance are not covered. If insurance won’t pay, Florida homeowners can still afford a new roof through roof financing options like home equity loans, personal loans, PACE financing, and roofing company financing plans. Even with bad credit, there are financing solutions available to help you pay for a roof replacement without delay.

Why Roof Financing Matters for Florida Homeowners

Florida’s climate is tough on every roof. Between hurricanes, heavy rains, and constant humidity, it’s no surprise that many Florida homes need a roof replacement sooner than homes in cooler states. A roof repair may fix minor damage, but when your roof needs a full replacement, the cost of a new roof can be overwhelming.

On average, roof replacement costs in Florida range from $10,000 to $25,000, depending on roof size, pitch roofing, and the roofing material used. For many families, that’s not money they can easily pay upfront. That’s why roof financing is available, to help you finance your roof replacement through structured monthly payments instead of a lump sum.

By using the right roof financing option, you can replace your roof quickly, protect your property, and even improve your home’s energy efficiency. With flexible financing and financing solutions available, you don’t need to put off a critical roofing project just because of cost.

Understanding Roof Replacement Costs in Florida

Before you decide on the right roof financing option, it’s important to understand the replacement cost of your roof. Several factors affect the cost of your roof, including:

- Roof size & design – Larger and more complex roofs naturally cost more.

- Roofing material – Asphalt shingles are affordable, while metal and tile last longer but cost more.

- Roof installation complexity – Multi-level roofs or steep pitches increase labor.

- Roofing contractor fees – The reputation and expertise of your roofing contractor matter.

Most roof replacements in Florida fall between $10K and $25K. While expensive, this is a major home improvement investment that boosts property value, enhances energy efficiency, and ensures a secure roof against future storms.

Since few homeowners can afford this outright, financing your new roof becomes the practical solution. By spreading the cost of a new roof into a predictable monthly payment, you can get started immediately without sacrificing savings.

Insurance Coverage: Can It Pay for a New Roof?

One of the first questions a homeowner should ask is: Will insurance cover my roof replacement?

If your roof was damaged by a hurricane, hailstorm, or windstorm, your insurance policy may cover the replacement cost, making it feel like you’re getting a free roof, aside from your deductible.

Steps to maximize coverage:

- Get a free roof inspection from a licensed roofing contractor.

- Document all visible damage.

- File your insurance claim quickly.

Insurance does not cover normal wear, old age, or poor maintenance. That means if your roof needs replacement simply because it’s old, you’ll need to explore roof replacement financing options.

The good news? Many roofing companies offer financing plans and even help homeowners combine insurance coverage with financing solutions to reduce out-of-pocket costs.

You Might Also Like: Why SmartQuote is the Best Choice for First-Time Roof Buyers

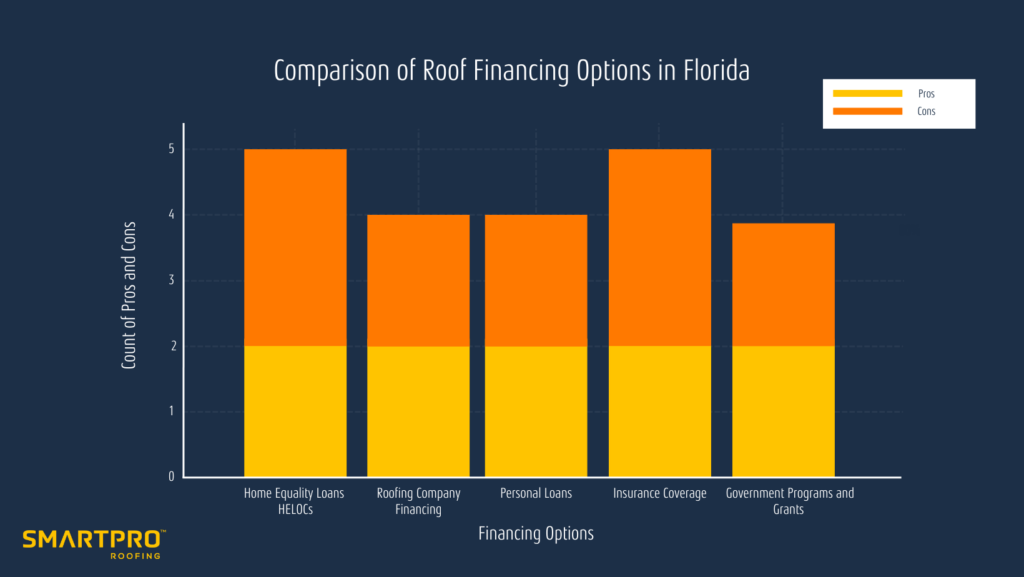

Home Equity Loans and HELOCs: A Popular Way to Finance Your Roof

For many homeowners, tapping into home equity is one of the best options to finance a roof replacement.

- Home Equity Loan – Fixed interest rate and predictable monthly payment. Great for budgeting.

- Home Equity Line of Credit (HELOC) – Acts like a credit card, letting you borrow only what you need.

Both provide lower interest rates than personal loans, but you’ll generally need a credit score of at least 620 (ideally a credit score of 700). Since your home is collateral, missing payments can put your property at risk.

Still, for Florida homeowners with equity, this is often the most cost-effective roof financing option.

Personal Loans and Credit Options for Roof Replacement

Not every homeowner has equity, which is why personal loans are another popular way to finance a roof replacement.

- Personal Loan Pros: Quick approval, no equity required, and fixed financing terms.

- Personal Loan Cons: Higher interest rates compared to home equity loans.

For those with bad credit, approval may still be possible, though rates will be higher. Some turn to credit cards or personal loans as short-term fixes, but be cautious: high interest rates can make this costly if balances aren’t paid quickly.

This option works best if you need to pay for a new roof immediately, especially when roof repairs or replacement can’t wait.

Roofing Company Financing Plans: Simple Roof Financing Options

Many roofing companies offer their own in-house financing in partnership with lenders. This is one of the most straightforward roof replacement financing options because approval is fast, and you can schedule your roof installation immediately.

For example, SmartPro Roofing provides:

- Flexible financing with low or zero down payments.

- Multiple financing terms tailored to fit your budget.

- Assistance combining insurance coverage with financing.

This works best if you prefer one trusted provider to handle both the roofing services and the financing plan. For Florida homeowners, this is often the most convenient way to finance your roof since it avoids the hassle of third-party lenders and lets you get started on your roofing project without delays.

PACE Financing in Florida: A Unique Way to Finance Roof Replacement

Another powerful tool for Florida roofing is PACE financing (Property Assessed Clean Energy). This program allows Florida homeowners to pay for home improvement loans, including roof replacement, through their property tax bill.

Pros of PACE Financing:

- No minimum credit score required, making it available even with bad credit.

- Long repayment periods, reducing your monthly payment.

Cons of PACE Financing:

- Places a lien on your home, which can complicate selling.

- Limited to options in Florida where the program is approved.

For many, especially those struggling with bad credit, PACE is a practical way to finance a roof replacement even when traditional loans aren’t possible.

Government Programs and Grants for Roof Replacement Financing

In addition to private lenders and roofing companies, some government-backed financing solutions exist for Florida homeowners.

- Federal Housing Administration (FHA) Title I LoanFHA Title I Home Improvement Loans – Flexible terms and moderate requirements.

- Local grants – In some cases, municipalities offer programs for replacement in Florida that improve weather resistance.

While approval may take longer, these can be some of the most affordable options for roof replacement. If you qualify, it’s worth applying since financing terms are usually more favorable than private lenders.

Financing a Roof Replacement with Bad Credit: What Are Your Options?

A low credit score doesn’t mean you’re stuck with a leaking roof. You can still finance a roof replacement even with bad credit using:

- PACE financing (no traditional credit check).

- Roofing company financing plans that accept bad credit borrowers.

- Personal lenders who specialize in home improvement loans.

While you may face higher interest rates, it’s better than delaying a roof replacement and risking water damage. In fact, some lenders work specifically with Florida homeowners who need to pay for necessary roof repairs or replacement quickly.

The key is to explore your options, compare lenders, and find a financing plan that matches your budget. Even with bad credit, there are financing options available to help you pay for your roof replacement today.

Smart Tips to Choose the Best Roof Financing Option

With so many financing options available, how do you choose the right one? Here are smart tips for financing your new roof:

- Set a budget – Decide on a realistic monthly payment you can afford.

- Check your credit score – A good credit profile unlocks better rates.

- Compare financing terms – Don’t just focus on interest rate, review the total cost.

- Work with a trusted roofing contractor – Many roofing companies offer financing and help with insurance claims.

- Don’t delay – The longer you wait, the higher your roof replacement costs may climb due to damage.

If your roof needs replacement, the smartest step is to partner with a quality roofing company that can guide you through roof replacement financing options and ensure you get the best options for your situation.

SmartPRO Roofing: Making Florida Roof Financing Simple

Replacing your roof is a major investment, but with SmartPRO Roofing, you don’t have to let cost hold you back. We combine flexible financing plans, expert guidance on navigating insurance coverage, and the use of premium materials engineered for Florida’s weather challenges. Our SmartQuote Tool gives you exact pricing in under an hour using advanced satellite imagery, so you can see how much your project will cost, before you make a decision.

Take control of your budget and your home’s protection today. See how much you could save with our SmartQuote Tool and savings calculator.